On Monday came the news that Swedish textile recycling darling ‘Renewcell’ was bankrupt. Renewcell was a textile ‘advanced’ or ‘chemical’ textiles recycler who aimed to process mostly-cotton textiles (such as bedsheets and jeans) with a series of chemical treatment steps to produce a substitute for wood pulp from trees, which was intended to make, for the most part, viscose fibres. Renewcell had, for the past few years, been considered a forerunner in the advanced textile recycling space. We will shortly get into why that was, and whether it was justified. However, despite the news, it may not yet be the end of the story – somebody may come in to rescue the company or snap up their IP, and the company is trying its best to put on a positive spin on recent developments. According to their latest statement, stocks of Renewcell’s ‘Circulose’ pulp are with suppliers and a sufficient stock exists for up to two years or production. So this is definitely not the end of the road just yet.

Over the years, I have been asked about Renewcell more than any other company in this a space. I’ve commented in publications both large and small, including recently in the New York Times, on their progress and at certain points in their rise. Renewcell was the leading, the one leading the pack, the one everyone wanted to know about. What was their secret? Why are they ‘ahead’? What does this mean for everybody else? In our work with brands, investors, and innovators the topic was front and foremost in conversation about the advanced recycling space in textiles. One of the first articles I posted on LinkedIn was an explainer on the technology behind Renewcell. To say I have a history of commenting on this space, and of Renewcell in particular, is putting it mildly. I’ve generally always been as positive as I can be and strived to give an accurate and balanced view on the topic, before everything, grounded in the realities of the science and scaling of deep chemical technologies.

I have refrained in the past year or so from saying much at all about the ongoing public woes of Renewcell, as I know all too well the pressures that are being faced by innovators and didn’t particularly want to pour any fuel on the fire, given I am an outspoken supporter of the space at large. Generally, I am extremely sad to hear that they didn’t pull through in the end and it’s difficult news to digest.

In the past few days, and no doubt in the days to come, we have and will hear a range of takes, from the insightful and nuanced to the more hyperbolic and critical. Some will pronounce that the idea of circularity in fashion is dead, whilst others want to rally the industry to pull together in the face of common difficulties.

Given my history of commenting on the topic, I thought I would throw my lot in. I do believe a sober analysis of the situation is needed, which I have no doubt others will also make, however, there are many points to cover, and some which have already been made, that we can’t possibly discuss and dissect every aspect of their misfortune. But there a few key aspects that I want to focus on:

- Why all this focus on Renewcell, and is the bankruptcy significant for the space at large?

- Why was this all harder to scale than expected?

- What lessons can be learned, that could be applied by others in this space? What can innovators do to maximise their chance of success?

Renewcell: Why All The Fuss?

It’s important to take a step back and first look at why we are even all taking about Renewcell in the first place. Why was so much attention focused on this one company?

In the space of fibre (or textile) to textile recycling, Renewcell received so much attention mainly because they were the ‘furthest’ ahead in terms of scale than other similar innovators, not necessarily because they had the most innovative technology, the ‘best’ product, or the most bullet-proof business plan. Obviously, they had many backers that thought they did, but there are also competitors, and others taking different approaches which are equally as valid. They had what can be best described as an early-mover advantage. An advantage, which, in the end, didn’t insulate them from the realities of market forces and the business environment which dictates whether they live or die.

Renewcell’s technology drew from a common background of knowledge and understanding in the pulp and paper space and was originally a spin-out of university KTH in Sweden. Generally, university spin-outs do have a leg up, because they are starting with a body of R&D developed using public or private money, often over many years, meaning at their ‘founding’ they are already much further ahead than companies that start from the ground up on day zero. This already put them a few years ahead in their development timeline. Then, due to the similarity of the chemistry and the actual process equipment to existing pulp and paper operations, scaling was simplified as existing machinery and infrastructure (such as existing pulp factories) could be, to a degree, leveraged for their own process. Renewcell refurbished old pulp and paper facilities, including a whole former pulp factory, for their own use, which cuts down on the development timeline significantly. That is not to say it was smooth sailing, throughout the years there were many setbacks both technologically and economically, with many delays to their scaling of production and the build of the progressively bigger plants.

In previous years I have cautioned against thinking that because they are the seemingly the furthest ahead, they are the ‘winner’, and that one needn’t look any further. As I mentioned, there are many valid approaches to achieving a ‘circular’ cellulose fibre ecosystem, and Renewcell is one of many. Given that all but the closest partners do not have a real window into the internal workings of the company, we cannot always know, in the end, who will make it and who will not. It’s a race with multiple participants, and sometimes, the leader of the pack is not the one who will eventually win the race. In fact, there will be more than one winner, a range of companies who adapt their technologies to the reality of the feedstock supply, the market drivers for the product, and the general business environment. There will in reality not be any one ‘winner’. But that does not mean that some won’t fall behind or drop out of the race entirely. We should expect more high-profile failures, but also some high-profile successes.

What Does This All Mean? And Why Was This Harder to Scale Than Expected?

So, this brings us to the question of whether Renewcell’s demise is a wider harbinger of doom for the textile ‘advanced recycling’ sector. The answer is – no, at least not in the long term. It will certainly make the environment more challenging for new entrants, but this also brings with it opportunities – to recognise where mistakes have been made and to plan accordingly.

Renewcell’s technology, whilst being appropriate for a very narrow slice of the available textile feedstock (i.e. mostly pure cotton of known composition), was not necessarily the most innovative, out of all the approaches in this space, and in general was rather limited in its capabilities, especially for dealing with non-cellulosic contaminants. Which in itself, is not necessarily a bad thing, if there is a business case for it its use, which includes consideration of the both the feedstock going in, and the product coming out. However, it’s product was a niche subset of a niche subset of a niche fibre (i.e. a recycled subset of ‘sustainable’ rayon i.e. viscose and lyocell, which are themselves only a small minority of the overall fibre stock), meaning the market for its product is in general relatively small. The feedstock going in was confined to relatively pure cotton, which would need to be extremely consistent in its composition and purity level due to the confines of the technology, which is no easy task. These are all confounding difficulties, but again could be overcome given the right incentives and a sound go-to market strategy and business plan.

Furthermore, they took a rather bold strategy – scaling to production scale, using a public IPO strategy (i.e. a huge amount of investment, whilst also leaving themselves open to being dictated by the market) before ever generating sustainable revenue or reaching reasonable operation costs and subsequent pricing of its material, essentially based on promise of future purchases from major brands. This in of itself is a very risky proposition. However, I will leave others with more expertise in the financing space to comment on the pros and cons of such a strategy. In the end, Renewcell simply ran out of money before they could scale their technology and iron out all the issues in their production.

Perhaps one of the most important contributing factors to the end of their runway, was their strategy to be a supplier of the raw material to make fibres, a kind of cellulose pulp, rather than fibres, a strategy which may have made sense at the time, but has since shown to significantly increase the time to market of actual garments made from their raw material.

There is one key problem with this strategy – brands do not buy cellulose pulp – they also do not buy lyocell or viscose fibres, yarns, or textiles – they buy finished garments.

The Product Is King – Or Why ‘Integrateability’ Is Critical

One critical aspect, I think, that has been often overlooked is that Renewcell’s main offering was never a ‘drop-in’ material feedstock in the way that many though it was, and it was often advertised as being.

A drop-in would be something like a bio-based version of an existing synthetic polymer, such as PET or LDPE, which is chemically and physically identical to its counterpart. These would slot seamlessly into the supply chain, without minimal changes needed (not considering any economic parameters, such as cost).

Whilst the ‘alternative pulp’ output from Renewcell is, on paper, similar to dissolving pulp, the specifications are designed originally for wood pulp from traditional chemical pulping process. Although it is nearly all cellulose, and is a similar average ‘chain length’ of cellulose polymers (known as the degree of polymerisation) to wood pulp, it would never be exactly the same, and it would also not be exact the same ‘distribution’, leading to slightly differing flow properties of the polymer solution. It is known from the scientific literature that alternative pulps may require tailoring of spinning conditions to achieve good results. These changes may in some cases be a positive development, when tailored to the specific input, recycled cotton-pulp rayon fibres have been shown to be remarkably high tenacity (strength) in comparison to some wood pulp-based fibres. However, the fact that some tweaks and changes in the process may be needed is significant. It means it is not, in the end, a true ‘drop in’ product. In fact, the issue was clearly highlighted by Renewcell’s CEO in earlier comments on their ongoing troubles, where he mentioned “delays in the calibration of new material in their fibre production lines” as a key issue in their delay getting to market.

Additionally, they need to ensure purity levels are always within tolerance, which at a large scale is a tricky task, given that the nature of a waste input means things are ever changing. The quality control on the input and output side needs to be beyond robust. In comparison, existing wood pulping operates on a predictable feedstock which is relatively similar, day in, day out.

Think about it from the perspective of a large viscose manufacturer. They would have to shut down and shift production of multiple spinning lines, tailored specifically to make this new viscose product, or at least invest in additional spinning lines to do this. Not only that, but they need to be sure that they are going to get a product which is consistent in quality and physical properties every single time, without fail, in order that their own product is of a consistent output quality – no inhomogeneity, no defects. Given the amount of money that is at stake, shutdowns in production due to bad feedstock and product failures cannot be tolerated at this level. Given all this, what incentives do these viscose manufacturers have, to make this switchover, given the risks are seemingly so high, and given the demand, seemingly, was so low?

This is really one of the core issues at play in the problems that Renewcell had.

But then, this example is only one step in the chain needed to make a garment. These dilemmas, these calculations are relevant for every player in this chain. A chain that ultimately ends up with the buyers at major fashion brands. The only thing that would have changed the calculus for all the actors in this chain was if the demand for the product was so high, that the business case so enticing, that investment in buying these new ingredients and making these new ‘more sustainable’ products was a no-brainer.

What Lessons Can We Apply To Other Innovators? How Can We Predict ‘Chance of Success’ in This Space?

Could the sustainability champions at major brands have pulled their act together and generated enough demand to pull their textiles through this very long, disparate and complex supply chain? Maybe, with enough time. But in general, unlike some others, I don’t place the blame at the brands doorstep. For the most part, major brands do not act with one will and are full of competing interests, even if the sustainability and innovation departments are championing these technologies. I do believe, for the most part, everybody in this chain was acting rationally within their own remit and shouldn’t be particularly blamed for Renewcells’ troubles.

Bringing this all together, I would like to propose an explanatory model, that could perhaps be applied to many examples in the deep tech, materials and advanced recycling space now and in the future.

This builds upon this recent article in Ecotextile news that I contributed to, as well concepts such as the ‘Supply Chain Readiness Level’, which can be considered as a complement to the technology readiness level (TRL), and models we have developed internally for evaluating innovators. This model builds upon the assumption that the technology is ‘technically’ ready and appropriate for the desired feedstock and product.

All of this adds up to answer the question: is there actually a viable market for this product?

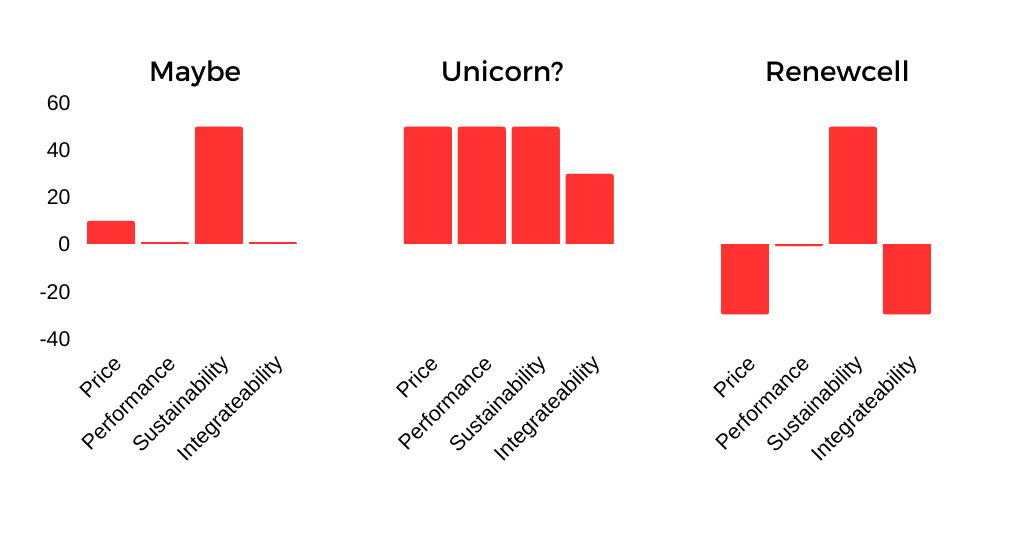

I believe it can really be boiled down to the following 4 factors:

- Price

- Performance or ‘Desirability’

- Sustainability

- Supply Chain ‘Integrateability’

(2) Would include physical properties (such as strength, elasticity), as well as other value-added qualitative aspects such as hand feel, lustre, appearance, being equal to or better than existing materials in the same category, or even being unique enough to make it worthwhile to explore the material on its own merits.

We can imagine the scale as a +/- value on each point, where the more positive the total sum, the greater the chance of scaling the innovation. To have a fighting chance, therefore, the product offering would need to be at least ‘neutral’ in all of the categories in comparison to the incumbent, whilst excelling in one or ideally more of the other categories. To a degree, a very high performance in the other factors may offset a lower performance in other categories, i.e. a material that is high performance, very sustainable, and that fits seamlessly to the current supply chain, could potentially be marketed as a premium product and command a higher price. But this is a very rare combination indeed. The theoretical best option would be a material that is at least at least neutral to cheaper in price, has some performance benefits, is much more sustainable, and is easily able to fit into the existing value chain. But as others have pointed out – does such a technology even exist?

Therefore, as I mentioned I believe it’s more likely for a technology which is at least in parity with the incumbent in most categories whilst excelling in perhaps one. A material, for example, which is similar to the incumbent in all categories but is significantly more sustainable, for example, may be enough to push it over the line into adoption. But if this material is suddenly more difficult to integrate into the existing value chain, AND is quantitively or qualitatively worse in performance this would become a very difficult prospect.

So, while Renewcell may have hit points (2) and (3), Price and Integrateability were still barriers. Naturally, price is linked to many other factors, including the operating cost of the actual process, their financial situation and the market for the actual product, all of which will have had some relevance in Renewcells’ case.

Maximising your chance of success in each of these categories could be a good way to strategise a path to market for a developing deep tech material technology. However, that is not to say that it is any guarantee of success. And an innovator only slightly lacking in one of more of these categories may be able to push through, given enough money and time – which Renewcell ran out of.

Perhaps the hidden ‘5th’ element of this model could be considered luck and timing. That is, you could do everything right and still fail, through no particular fault of your own – too early, too late – a critical opportunity missed because you were not in the right place, at the right time. Who knows what actions or decisions, or random turns of luck may have turned things around for Renewcell – perhaps we will never know.

What Does The Future Bring? What Can Innovators Take Away From This?

Then to the future. At lot of commentators in this space will want to paint the future in a negative light, and in part some are right to be at least a little worried. As I mentioned, there are likely to be more failures in the future. But the clever ones will change tack, or have set out from the outset to avoid mis-steps by the early riders such as Renewcell. Here are a few points which innovators may wish to consider:

- The customers are not the brands. Champions, maybe, who are important to have on side. Focus on the actual immediate customer of your product, and the incentives that drive them. For the most part, they are going to want predictable, high quality, dependable products which are easy to integrate into production, and offer a compelling business case for their use.

- Build out the downstream supply chain – or bring as much in-house as feasibly possible. Previously, it looked as if focusing on the core proposition, such as the actual textile recycling, and not the fibre spinning, was a sound strategy. It is worth considering bringing fibre production and potentially other downstream steps in-house.

- Build a sustainable revenue, self-supporting business first, then scale. Going to an IPO at an early stage before making sustainable revenue is risky. Technologies that scale well at lower overall volumes and with lesser initial investment will be better placed in the long term.

- Focus on the feedstock. Not only is a portion of the cost involved in purchasing and preparing the feedstock, but the consistency of supply, the pre-preparation and sorting will determine the parameters of the process, and the quality of the output product. Making sure this is delivered at scale is a challenge.

- Develop robust and flexible technologies. The technology needs to be appropriate for the chosen feedstock and able to tolerate at least some minor variation in composition, whilst producing a consistent product. At scale, big variations in output properties cannot be tolerated.

Is this the end for circular fashion? Absolutely not. Renewcell was one technology out of many that focused on a very small slice of the available textile waste, and produced a very specific product. Innovators, and others in the ecosystem, will surely learn from Renewcell’s mistakes. Investors and brands should rightly start asking tougher questions. Brands may also want to ensure their sustainability strategies permeate every level of their organisations, to be driven directly from the top. Hopefully, then, recent events will act as a catalyst and a wake-up call for the industry at large. But we should absolutely expect things to be shaken up a little along the way.

—

Dr. Ashley Holding is the Principal Consultant and Founder of Circuvate, an expert consultancy focused on sustainable and circular materials and recycling in the fashion, textiles and apparel sector.